Sustainability

Sustainability Report 2023

Download Sustainability Report (8.4 MB)

CLAS` properties are predominantly managed by Ascott. As at 31 December 2023, CLAS` portfolio comprised 51 Ascott-managed operational properties:

- This excluded four properties which were divested in September 2023. The environmental data for these properties prior to their divestments has been included in our reporting, where available.

- This included three properties which were acquired in November 2023. The environmental data for The Cavendish London and Ascott Kuningan Jakarta has been included in our reporting, while Temple Bar Hotel has been excluded as the property was undergoing transition from the previous third-party operator.

Properties which were in operation for less than 12 months and/or undergoing asset enhancement have been excluded from the computation of intensity data. In FY 2023, there were five Ascott-managed properties undergoing asset enhancement. In FY 2023, the properties which the computation of intensity data is based on accounted for 42.3% of the total revenue and comprised 46.8% of CLAS` total operational gross floor area.

The environmental performance of the remaining CLAS properties which are managed by third parties is being tracked and monitored. Scope 3 GHG emissions and energy consumption data for these properties have been disclosed in CLAS` Sustainability Report 2023, where available. In FY 2023, CLAS` properties for which GHG emissions and energy consumption data have been disclosed, accounted for 99.4% of the total revenue and comprised 98.1% of CLAS` total operational gross floor area.

Leader in Sustainability

2021, 2022 and 2023 GRESB Real Estate Assessment

Global Sector Leader (Listed – Hotel)

- Sustainability Commitment

- Board Statement

- Board, Top Management and Staff Commitment and Involvement

- Materiality

- Creating Value and Alignment to United Nations

Sustainable Development Goals (UN SDGs) - Policies

- Sustainable Finance

Sustainability Commitment (Based on Sustainability Report 2023)

CapitaLand Investment 2030 Sustainability Master Plan

The Managers are part of CapitaLand Investment Limited (CLI) and our sustainability strategy is aligned to that of CLI.

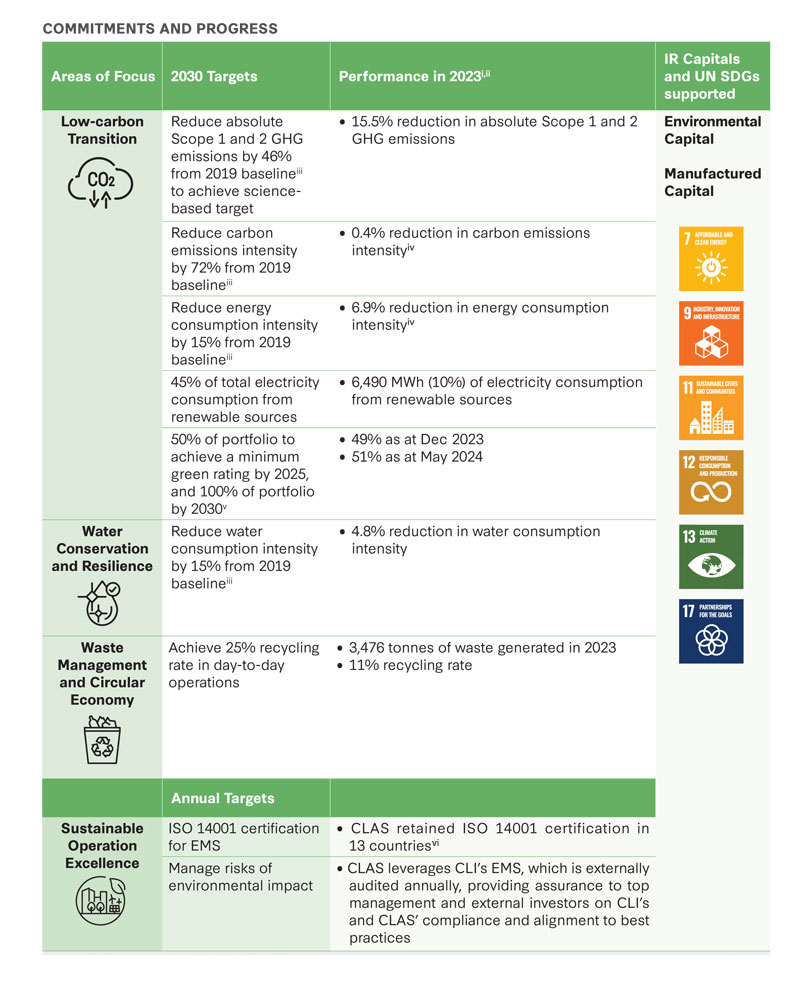

CLAS is aligned with the CapitaLand Investment 2030 Sustainability Master Plan unveiled in 2020 to elevate our commitment to global sustainability in the built environment. The Sustainability Master Plan drives CLI's sustainability efforts in the ESG pillars, enabling CLI to create a larger positive impact for the environment and society.

For more information on the CapitaLand Investment 2030 Sustainability Master Plan, please click here.

Ascott CARES

CLAS also aligns its sustainability goals with its Sponsor, The Ascott Limited (Ascott). Ascott is a wholly-owned business unit of CLI and a leading vertically-integrated lodging operator. Headquartered in Singapore, Ascott`s presence extends across more than 220 cities in over 40 countries in Asia Pacific, Central Asia, Europe, the Middle East, Africa and the USA.

Ascott`s sustainability programme, Ascott CARES, is a Global Sustainable Tourism Council (GSTC) - recognised programme centred around five fundamental pillars of Community, Alliance, Respect, Environment and Supply chain.

For more information on Ascott CARES, please click here.

Board Statement

At CLAS, sustainability is at the core of everything we do. We are committed to growing in a responsible manner, delivering long-term economic value, and contributing to the environmental and social well-being of our communities. CLAS` material environmental, social and governance (ESG) factors are aligned with CLI 2030 Sustainability Master Plan (SMP), which was refreshed in 2023 and endorsed by CLAS` Boards and Management.

The SMP steers our efforts on a common course to maximise impact through building portfolio resilience and resource efficiency, enabling thriving and future-adaptive communities, and stewarding responsible business conduct and governance. Ambitious ESG targets have been set which include carbon emissions reduction targets validated by the Science Based Targets initiative (SBTi). In 2023, the SMP targets were revised to elevate the SBTi-approved targets in line with a 1.5ºC scenario, incorporate CLI`s Net Zero commitment and enhance its focus on social indicators.

CLAS` Boards are responsible for overseeing CLAS` sustainability efforts, and take ESG factors into consideration in determining its strategic direction and priorities. The Boards also approve the executive compensation framework based on the principle of linking pay to performance. CLAS` business plans are guided by both quantitative and qualitative performance targets, and executed through sustainable corporate practices.

CLAS` sustainability efforts have been recognised by global indices such as GRESB. We will continue to identify and adopt meaningful ESG practices and enhance sustainability in our business.

Board, Top Management and Staff Commitment and Involvement

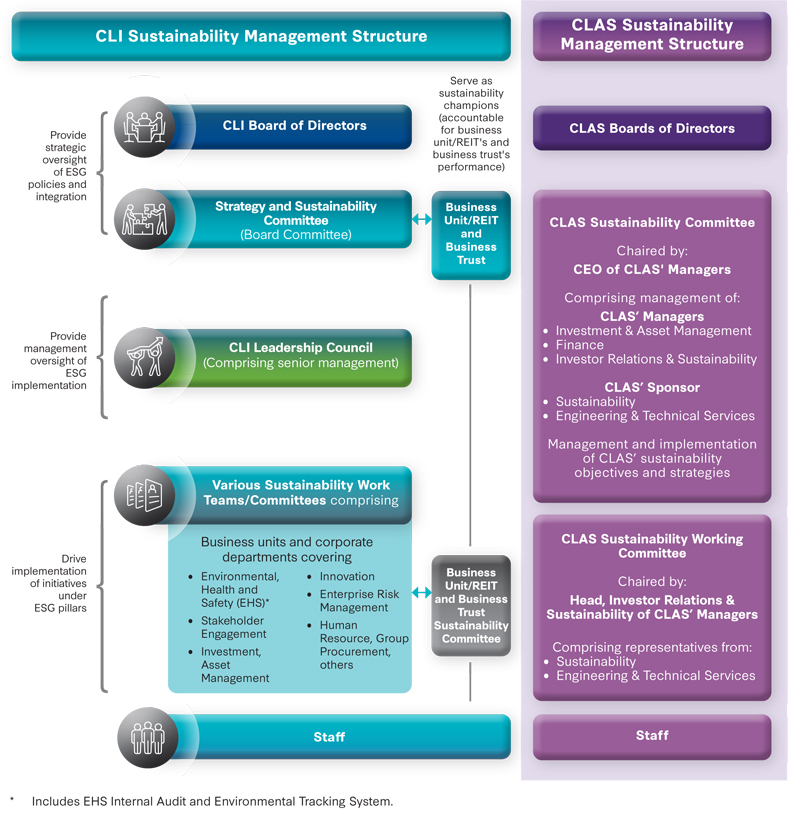

CLAS` Boards recognise the importance of sustainability as a business imperative, and ensure that sustainability considerations are factored into CLAS` strategy development. This enables CLAS to remain competitive and resilient in an increasingly challenging business environment.

The Boards are kept informed of CLAS` sustainability management performance, key material issues identified by stakeholders, and the planned followup measures. The Boards are updated quarterly and at ad hoc Board meetings. The Boards discuss matters relating to sustainability risks, and relevant performance metrics, which include carbon emissions and our progress on achieving the reduction targets, green certification, human capital development, as well as stakeholders` expectations on climate change, social impact and/or other matters. The Boards are also informed of any incidents relating to workplace safety, business malpractice and environmental impact, which may include climate-related damage or disruptions.

CLAS` Sustainability Committee is responsible for overseeing CLAS` sustainability strategies and goals, and monitoring the progress of the sustainability initiatives. CLAS` Sustainability Committee comprises the CEO and Heads of Department of CLAS` Managers, and the Heads of Department of the operations and technical teams of its Sponsor. A Sustainability Working Committee, led by the Head, Investor Relations & Sustainability, provides support to the Sustainability Committee.

At CLI, lead Independent Director Mr Anthony Lim chairs the Strategy and Sustainability Committee (SSC), which is a Board Committee of CLI. The SSC typically meets twice a year, with additional meetings convened as necessary. The CLI Leadership Council makes strategic resource allocation decisions and meets on a regular basis. The CLI Leadership Council comprises the Group CEO, CEOs of the business units and key management officers of the corporate office.

The sustainability work teams comprise representatives from CLI business units and corporate functions. Each business unit has its own Environmental, Health and Safety (EHS) Committee to drive initiatives in countries where it operates with support from various departments.

Materiality

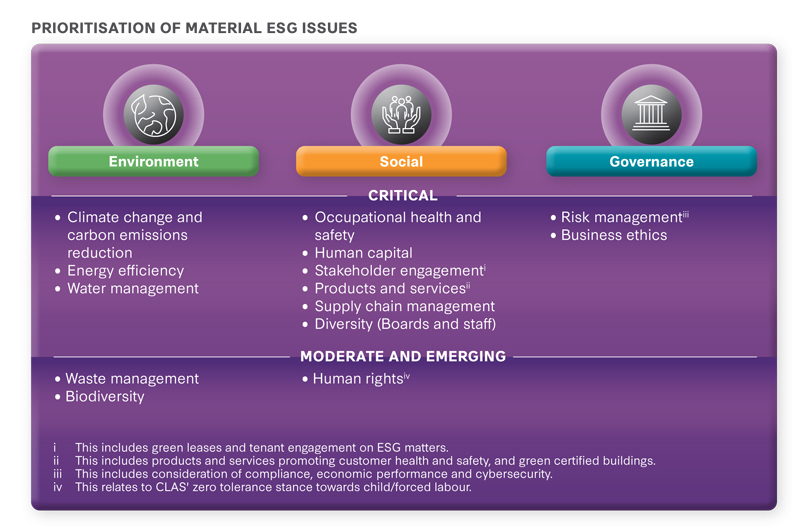

CLAS identifies and prioritises the management of material ESG issues that are most relevant and significant to the trust and its stakeholders. CLAS adopts a double materiality approach, considering issues which are material from either the impact perspective or financial perspective1 or both.

Potentially material ESG issues arising from activities across CLAS` value chain (including potential risks and opportunities in the immediate and longer term) are primarily identified via ongoing engagement with its stakeholders and reviews of sources including investor questionnaires, as well as ESG surveys, benchmarks and frameworks such as GRESB.

In addition, CLAS has a regular review, assessment and feedback process in relation to ESG topics. Identified material issues are reported in our corporate risk register through the annual Group-wide Risk and Control Self-Assessment (RCSA) exercise2, which identifies, assesses and documents material risks and the corresponding internal controls to manage those risks. These material risks include fraud and corruption, environmental (e.g. climate change), health and safety, and human capital risks which are ESG-relevant. Identified material ESG issues are then prioritised based on the likelihood and potential impact of issues affecting the business continuity of CLAS. For external stakeholders, priority is given to issues important to the community and applicable to CLAS. In FY 2023, the material ESG topics that were identified were approved by the SSC and endorsed by CLAS` Boards.

1 Taking reference from the SASB Standards for Real Estate and Real Estate Services, which identify sustainability factors that are material to short, medium, and long-term enterprise value for the industry.

2 For more information on CLAS` Enterprise Risk Management and Group-wide Risk and Control Self-Assessment exercise, please refer to pages 87 to 92 of CLAS` Annual Report 2023.

Creating Value and Alignment to United Nations Sustainable Development Goals (UN SDGs)

CLAS` Sustainability Report 2023 incorporates elements of the Integrated Reporting (IR) Framework of the International Financial Reporting Standards (IFRS) Foundation such as the six IR capitals – Environmental, Manufactured, Human, Social and Relationship, Organisational and Financial, and also references eight United Nations Sustainable Development Goals (UN SDGs).

CLAS also adopts a progressive approach towards climate-related disclosures in line with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations and Sustainability Accounting Standards Board (SASB) real estate sector-specific standards in the report.

Environment

- Computation of footprint data is based on available information of the Ascott-managed properties and excludes third-party managed properties.

- Computation of intensity data excludes new properties which were in operation for less than 12 months, properties undergoing asset enhancement programmes and third-party managed properties.

- Using 2019 as a baseline as the CLI 2023 SMP was introduced in 2020.

- Intensity figures relate to purchased energy and natural gas only, and exclude diesel fuel (non-vehicle) and other fuels (vehicle).

- By gross floor area in m2.

- CLAS has adopted CapitaLand`s Environmental Management System (EMS), which is integrated with CapitaLand`s Occupational, Health and Safety Management System (OHS Management System) to form CapitaLand`s Environmental, Health and Safety Management System (EHSMS). An internal audit system ensures conformance and effective implementation to international standards. Internal audits are conducted at least once a year. In addition, the EHSMS is audited annually by a third-party accredited certification body to the ISO 14001 and ISO 45001 standards, for 13 out of the 15 countries that CLAS is present in. Approximately 88% of CLAS` properties (by property count) are located in the 13 countries.

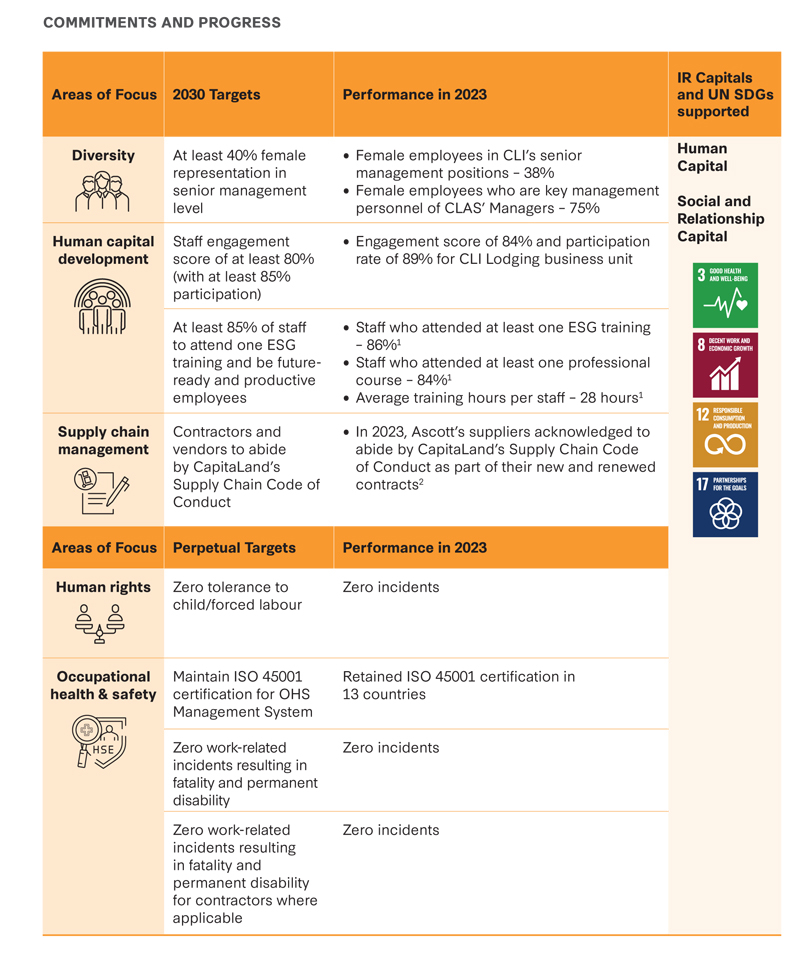

Social

- Excluding interns, trainees, temporary and outsourced staff, and employees from the three properties which were acquired in November 2023 and the four properties which were divested in September 2023.

- With the exception of certain contractual arrangements which are waived or excluded.

Governance

- Computation of FBC training statistics is based on staff strength as at 21 August 2023 (being the starting date of the training), excluding interns, trainees, temporary and outsourced staff, employees on long leave and employees from the four properties which were divested in September 2023.

Policies

The Managers are part of CapitaLand Investment Limited (CLI) and we are aligned with CLI`s policies.

Social Charter, Diversity & Inclusion Policy, Harassment Policy

CapitaLand has a Social Charter which sets out commitments to support the preservation of human dignity and self-respect of every individual, covering topics on human rights, child labour, forced labour harassment, human trafficking, code of conduct, diversity and inclusion, and healthy work-life balance. Applicable to all staff, the policy guides CapitaLand towards ensuring a supportive and respectful environment for individuals across all aspects of the business and operations.

CLAS embraces diversity, equity and inclusivity regardless of age, religion, gender, race, nationality and family status. CLAS is guided by CapitaLand`s Diversity & Inclusion Policy, which expects employees to foster a culture of diversity and inclusion, where different perspectives, experiences and skillsets are respected and valued.

To find out more:

- CapitaLand Social Charter click here

- CapitaLand Diversity & Inclusion Policy click here

- CapitaLand Harassment Policy click here

Fraud, Bribery and Corruption Risk Management Policy

CLAS adopts a zero-tolerance stance against any Fraud, Bribery and Corruption (FBC) in the conduct of its business activities and expects all its employees to be committed to the highest standards of integrity in their work and business dealings. The FBC Risk Management Framework has been set in place to manage FBC risks in an integrated, systematic and consistent manner.

CLAS abides by CLI`s FBC Risk Management Policy, which reiterates Management`s strong stance against FBC and sets the overarching approach in managing FBC risks. The Managers` zero-tolerance policy on bribery and corruption extends to their business dealings with third parties (including contractors, subcontractors, suppliers, consultants, agents, representatives, and others performing work or services for or on behalf of the Managers). Pursuant to this policy, the Managers require that certain agreements incorporate anti-bribery and anti-corruption provisions.

Suppliers who have acknowledged CapitaLand`s Supply Chain Code of Conduct are required to conduct themselves ethically, respect local laws and regulations, and strictly prohibit bribery and corruption in any form. Suppliers are encouraged to report all actual breaches or concealment of any forbidden acts including but not limited to anti-bribery and anti-corruption, unfair business practices, conflict of interest and gifts and gratuities.

Please click here to read CLI`s FBC Risk Management Policy.

CapitaLand Supply Chain Code of Conduct

CapitaLand is a signatory to the United Nations Global Compact (UNGC), and the Group is committed to the ten principles of UNGC by incorporating it into its business strategies, policies and company cultures.

The CapitaLand Procurement Policy and CapitaLand`s Supply Chain Code of Conduct form the basis for CLAS` engagement with our supply chains to influence them to operate responsibly in the areas of anti-corruption, child labour, forced labour, human rights, health and safety, as well as environmental management.

Click here to find out more about the Supply Chain Code of Conduct.

Sustainable Finance

CLAS continues to align our environmental goals with our financing needs, collaborating with like-minded stakeholders in the financing and investment community.

To date, CLAS has raised about S$551.2 million through sustainable financing.

In February 2022, CLAS` Sustainability-Linked Finance Framework was published, demonstrating its commitment to sustainable financing and serving to align CLAS` ESG goals with the CLI 2030 Sustainability Master Plan. CLAS also obtained a Second-Party Opinion from Moody`s ESG Solutions on its Framework.

For more details, please refer to the Sustainability-Linked Finance Framework and Second-Party Opinion here:

For more information on CLAS` sustainable financing efforts, please refer to the Sustainable Finance section under the Economic chapter of CLAS` Sustainability Report 2023, and the following links:

- CapitaLand Ascott Trust partners with the International Finance Corporation on its first sustainability-linked bond in the hospitality sector

- ART is first hospitality trust globally to issue sustainability-linked bond of S$200 million

- ART is the first hospitality trust in Singapore to secure green loan